Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Big picture: heading into 2025, the EGB market faced several headwinds, not least the ~500bn+ EUR in expected net bond supply, but also the extra ~170bn in PEPP redemptions that need to be absorbed by the market as the ECB steps away from reinvesting maturing bonds.

Why it matters: it was an open question as to whether (more nimble) private investors would so readily take up the baton, but those fears seem overrated, for now. Even France, marred in political noise, managed to raise a 10bn EUR 15-year syndication for books running above 134bn.

Zoom out: French 10-year OAT bond spreads are 30bps wider than one year ago after Macron’s knee-jerk snap election call and the political uncertainty that ensued.

Driving the news: the newly-appointed Bayrou government is expected to piece together a budget for 2025, and some investors are getting bullish again.

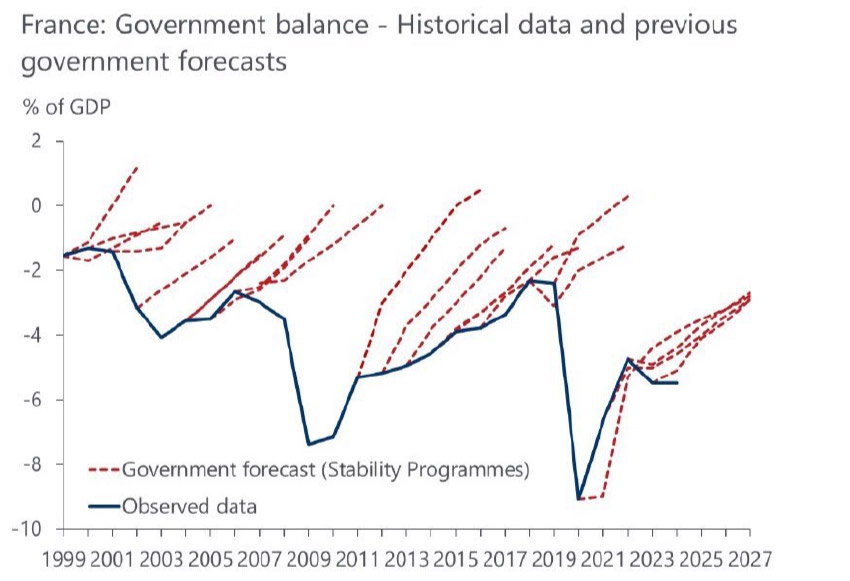

By the numbers: little political wiggle room means the budget deficit is projected to fall modestly this year to 5.4%, from 6% last year. Nominal GDP is running below 3% so closing this gap will be challenging. More salient is France’s record on fiscal forecasts, which let’s just say….isn’t great.

The bottom line: while the politics are a muddle – our thinking is to at least 2027 (next Presidential election) – French bond risk premia will remain elevated.

Source: @DanielKral1/X, Oxford Economics

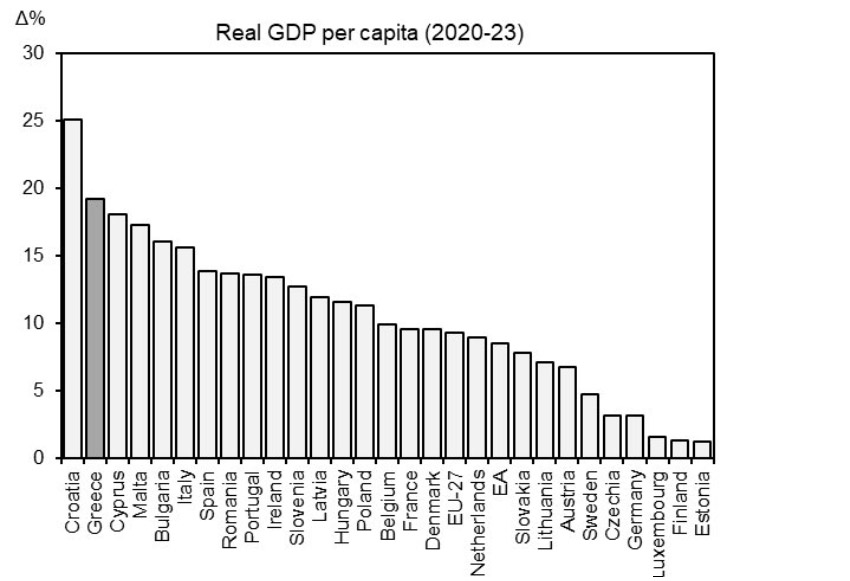

Zoom out: a return to IG status in 2023 and a PM recently lamenting ‘Germany must pull itself together’ exudes Greece’s newfound confidence among Europe’s power players.

Flashback: when we met Greek officials at the end of 2022, they were bemused that GGBs (Greece) were trading 50bps wider than similar maturity BTPs (Italy).

What they’re saying now: given Greece’s economic and fiscal trajectory, combined with the scarcity, the same officials told us there is no reason why GGBs shouldn’t be flat to PGBs (Portugal, some 40bps tighter).

The bottom line: that might be a bit ambitious given the large debt pile, but tighter France and even Spain is well within reach.

Source: @PatelisAlex/X, Eurostat

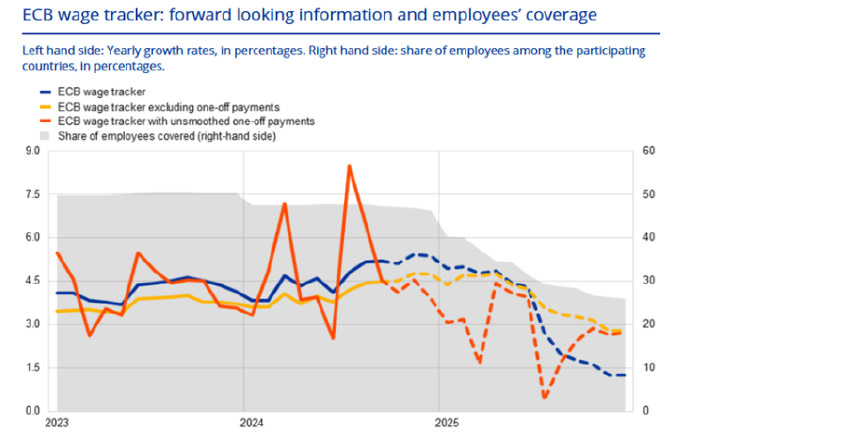

Context: the main policy rate is 2.75% after last week’s announcement, and the market is expecting another cut in April before pricing for further cuts becomes more spread out in the summer and H2.

The big picture: the ECB council are in a good spot in terms of cohesion, and the doves seem in control with many members in broad agreement that getting rates to neutral is a good plan. Moreover, wages are falling and the latest ECB lending survey points towards further credit tightening.

Reality check: we have largely seen the market price out the idea of cuts being front-loaded in, but the data and ECB-speak continue to point towards getting to a ‘neutral’ policy stance in earnest.

Opinion: we think neutral policy rate is between 1.75-2.25%.

Source: ECB, as at January 2025

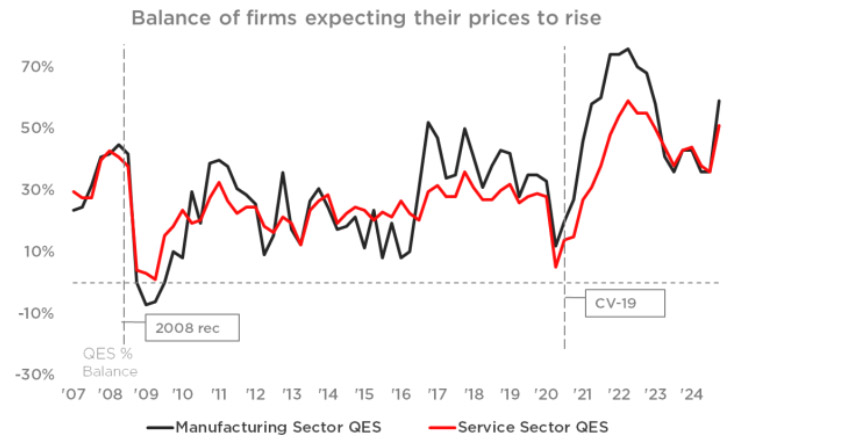

The big picture: gilt yields and GBP swap spreads have had a volatile start to the year on renewed inflation and growth concerns spilling over into a deteriorating fiscal profile, leaving the UK government with some tough choices regarding taxation and borrowing.

Flashback: the market rightly paranoid about anything UK-related after Autumn 2022, adding to sensitivity and risk premia.

Between the lines: the Labour government puts a lot of emphasis on sticking to its self-imposed fiscal rules (after relaxing them) in deliberate contrast to previous governments. Markets are therefore also putting more scrutiny on these rules as a harbinger for government credibility.

What’s next: a turnaround will need a big chunk of luck, partially on domestic inflation and global spillovers.

Opinion: a period away from the headlines might just give UK assets a short-term reprieve.

Source: British Chamber of Commerce

All date sourced from Bloomberg, as at January 2025.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.

This document is a marketing communication and it may be produced and issued by the following entities: in the European Economic Area (EEA), by BlueBay Funds Management Company S.A. (BBFM S.A.), which is regulated by the Commission de Surveillance du Secteur Financier (CSSF). In Germany, Italy, Spain and Netherlands the BBFM S.A is operating under a branch passport pursuant to the Undertakings for Collective Investment in Transferable Securities Directive (2009/65/EC) and the Alternative Investment Fund Managers Directive (2011/61/EU). In the United Kingdom (UK) by RBC Global Asset Management (UK) Limited (RBC GAM UK), which is authorised and regulated by the UK Financial Conduct Authority (FCA), registered with the US Securities and Exchange Commission (SEC) and a member of the National Futures Association (NFA) as authorised by the US Commodity Futures Trading Commission (CFTC). In Switzerland, by BlueBay Asset Management AG where the Representative and Paying Agent is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The place of performance is at the registered office of the Representative. The courts at the registered office of the Swiss representative or at the registered office or place of residence of the investor shall have jurisdiction pertaining to claims in connection with the offering and/or advertising of shares in Switzerland. The Prospectus, the Key Investor Information Documents (KIIDs), the Packaged Retail and Insurance-based Investment Products - Key Information Documents (PRIIPs KID), where applicable, the Articles of Incorporation and any other document required, such as the Annual and Semi-Annual Reports, may be obtained free of charge from the Representative in Switzerland. In Japan, by BlueBay Asset Management International Limited which is registered with the Kanto Local Finance Bureau of Ministry of Finance, Japan. In Asia, by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong. In Australia, RBC GAM UK is exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of financial services as it is regulated by the FCA under the laws of the UK which differ from Australian laws. In Canada, by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. RBC GAM UK is not registered under securities laws and is relying on the international dealer exemption under applicable provincial securities legislation, which permits RBC GAM UK to carry out certain specified dealer activities for those Canadian residents that qualify as "a Canadian permitted client”, as such term is defined under applicable securities legislation. In the United States, by RBC Global Asset Management (U.S.) Inc. ("RBC GAM-US"), an SEC registered investment adviser. The entities noted above are collectively referred to as “RBC BlueBay” within this document. The registrations and memberships noted should not be interpreted as an endorsement or approval of RBC BlueBay by the respective licensing or registering authorities. Not all products, services or investments described herein are available in all jurisdictions and some are available on a limited basis only, due to local regulatory and legal requirements.

This document is intended only for “Professional Clients” and “Eligible Counterparties” (as defined by the Markets in Financial Instruments Directive (“MiFID”) or the FCA); or in Switzerland for “Qualified Investors”, as defined in Article 10 of the Swiss Collective Investment Schemes Act and its implementing ordinance, or in the US by “Accredited Investors” (as defined in the Securities Act of 1933) or “Qualified Purchasers” (as defined in the Investment Company Act of 1940) as applicable and should not be relied upon by any other category of customer.

Unless otherwise stated, all data has been sourced by RBC BlueBay. To the best of RBC BlueBay’s knowledge and belief this document is true and accurate at the date hereof. RBC BlueBay makes no express or implied warranties or representations with respect to the information contained in this document and hereby expressly disclaim all warranties of accuracy, completeness or fitness for a particular purpose. Opinions and estimates constitute our judgment and are subject to change without notice. RBC BlueBay does not provide investment or other advice and nothing in this document constitutes any advice, nor should be interpreted as such. This document does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product in any jurisdiction and is for information purposes only.

No part of this document may be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose in any manner without the prior written permission of RBC BlueBay. Copyright 2025 © RBC BlueBay. RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated corporate entities. ® / Registered trademark(s) of Royal Bank of Canada and BlueBay Asset Management (Services) Ltd. Used under licence. BlueBay Funds Management Company S.A., registered office 4, Boulevard Royal L-2449 Luxembourg, company registered in Luxembourg number B88445. RBC Global Asset Management (UK) Limited, registered office 100 Bishopsgate, London EC2N 4AA, registered in England and Wales number 03647343. All rights reserved.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.